We can provide valuation assessments and advice for a number of uses outside financial applications. Our valuations can support other property decisions, including renovation feasibility, new build plan reviews, building energy efficient homes, setting a sale price or auction reserve, estate valuations, and private property purchases.

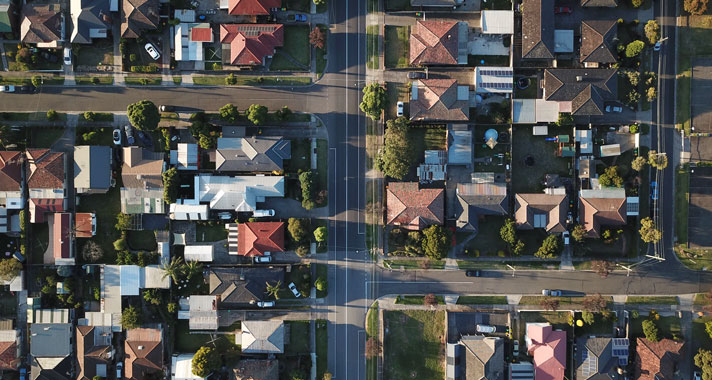

Passionate about property and valuation

Here at Valuation Partners, we specialise in providing valuation services. This means that our company structure and processes has been developed and optimised so that valuers can take the time to build productive relationships, and complete thorough analysis that result in valuation assessments that ensure our clients can make the best possible property decisions.

Check out our range of services

Specialised Services

Our valuation process

Our valuation process has been developed and optimized so that valuers can take the time to build productive relationships, and our partners and clients receive valuation advice of the highest standard, at a fair cost.

Interested in joining our team?

We are always looking for valuation talent to join our team – if you are a registered or near registered valuer looking for a new challenge with a progressive company, please get in touch. We have a variety of positions available and in locations ranging from Canterbury to Queenstown.